Paycheck tax estimator 2023

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Get Started Today with 2 Months Free.

Llc Tax Calculator Definitive Small Business Tax Estimator

Get Your Quote Today with SurePayroll.

. Its so easy to. Over 900000 Businesses Utilize Our Fast Easy Payroll. Contact a Taxpert before during or after you prepare and e-File your Returns.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. As per Federal Budget 2022-2023 presented by Government of Pakistan following slabs and income tax rates will be applicable for salaried persons for the year 2022. Ad Payroll So Easy You Can Set It Up Run It Yourself.

QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. The tax rate schedules for 2023 will be as follows. Learn About Payroll Tax Systems.

Estimate your federal income tax withholding See how your refund take-home pay or tax due are affected by withholding amount Choose an estimated withholding amount that. Important note on the salary paycheck calculator. 2021 Tax Calculator Exit.

This calculator is integrated with a W-4 Form Tax withholding feature. Know your estimated Federal Tax Refund or if you owe the IRS Taxes. It can also be used to help fill steps 3 and 4 of a W-4 form.

Most Americans are required to pay federal income taxes but the amount. Let us know your questions. Estimate your 2022 Return first before you e-File by April 15 2023.

The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. If taxable income is under 22000. The tax is 10 of.

Sign Up Today And Join The Team. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and. Tax Calculator Return Refund Estimator 2022-2023 HR Block How it works.

For married individuals filing joint returns and surviving spouses. Ad Pay Your Team And Access HR And Benefits With The 1 Online Payroll Provider. Our online tax calculator is in line with changes announced in the 20222023 Budget Speech.

Estimate garnishment per pay period. On the other hand if you are making more than 200000 in a year you will be paying. And is based on the tax brackets of 2021 and.

2023 Tax Calculator 01 March 2022 - 28 February 2023 Parameters Period Daily Weekly Monthly Yearly Periods worked Age Under 65 Between 65 and 75 Over 75 Income. All Services Backed by Tax Guarantee. Ad Takes 2-5 minutes.

You will be paying 62 social security tax on your income until you make 147000 a year. Ad Fast Easy Accurate Payroll Tax Systems With ADP. Salary Tax Calculator 2022-2023 SB Compliances SALARY TAX RATES Accounting Financial and Tax Management Services SB COMPLIANCES - SALARY TAX CALCULATOR fy 2022-23.

Although this is sometimes conflated as a personal income tax rate the city. Other Taxes You Pay Yes. The money also grows tax-free so that you only pay income tax when you.

Compare options to stop garnishment as soon as possible. Sage Income Tax Calculator. UK PAYE Tax Calculator 2022 2023 The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay.

Use this calculator for Tax Year 2022. The city of San Francisco levies a gross receipts tax on the payroll expenses of large businesses. Calculate how tax changes will affect your pocket.

It is mainly intended for residents of the US. How to calculate annual income. However making pre-tax contributions will also decrease the amount of your pay that is subject to income tax.

For example if an employee earns 1500. Try out the take-home calculator choose the 202223 tax year and see how it affects. Taxpayers whose employers withhold federal income tax from their paycheck can use the IRS Tax Withholding Estimator to help decide if they should make a change to their.

SARS eFiling Tax Practitioner Auto-assessment New to tax SARS Income Tax Calculator for 2023 Work out salary tax PAYE UIF taxable income and what tax rates you will pay INCOME Which. The Salary Calculator has been updated with the latest tax rates which take effect from April 2022. Calculate Your 2023 Tax Refund.

In case you got any Tax Questions. Based on the Information you. See where that hard-earned money goes - with UK.

Answer a few simple questions.

Paycheck Tax Withholding Calculator For W 4 Tax Planning

2022 Federal State Payroll Tax Rates For Employers

Paycheck Tax Withholding Calculator Your Pay Stub Or Check

2022 Federal State Payroll Tax Rates For Employers

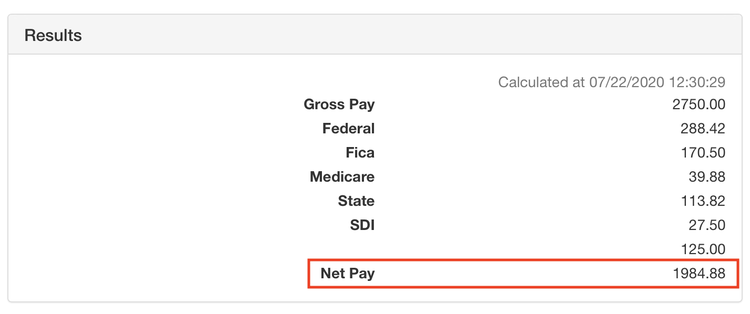

A Small Business Guide To Doing Manual Payroll

Paycheck Tax Withholding Calculator For W 4 Tax Planning

Estimated Income Tax Payments For 2022 And 2023 Pay Online

How To Calculate Taxes Using A Paycheck Stub The Motley Fool

Pre Tax And Post Tax Deductions What S The Difference Aps Payroll

2022 Federal Payroll Tax Rates Abacus Payroll

Pre Tax And Post Tax Deductions What S The Difference Aps Payroll

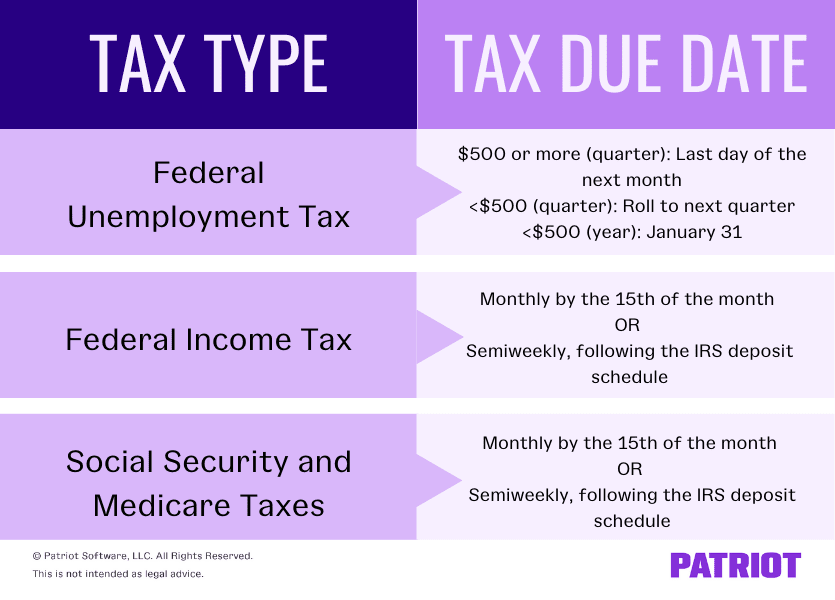

When Are Federal Payroll Taxes Due Deadlines Form Types More

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Ready To Use Paycheck Calculator Excel Template Msofficegeek

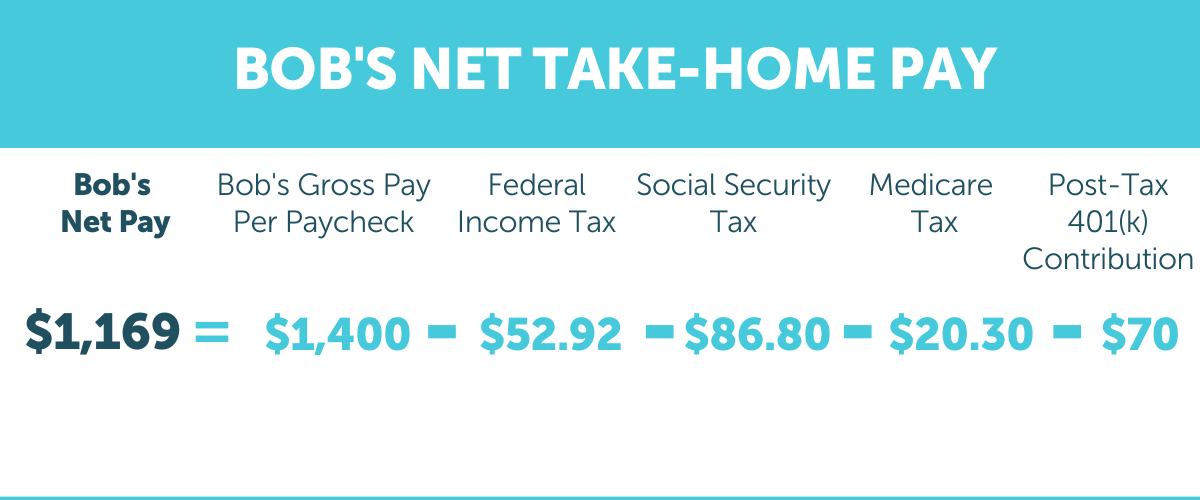

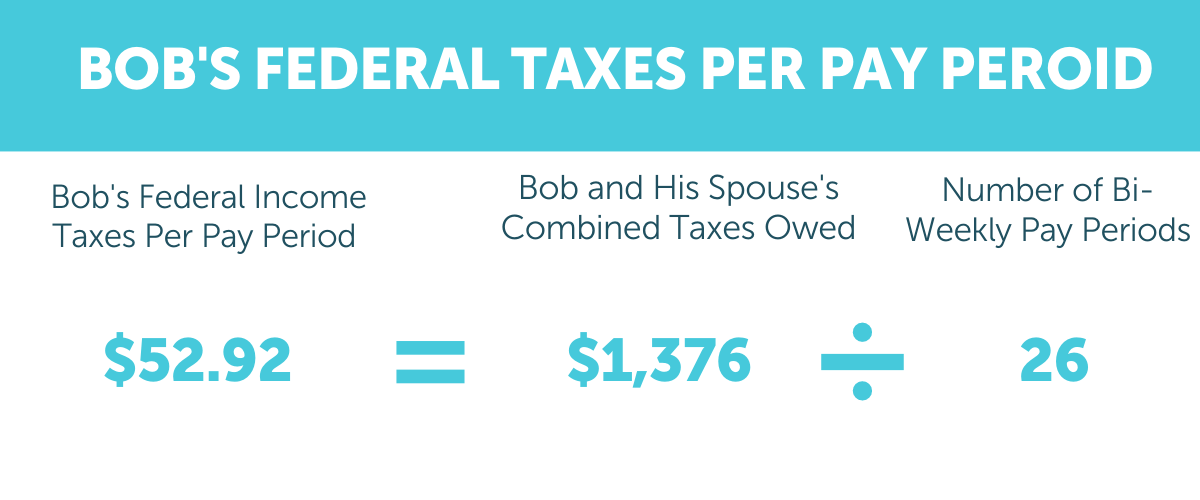

How To Figure Out How Much Your Paycheck Will Be After Taxes Quora

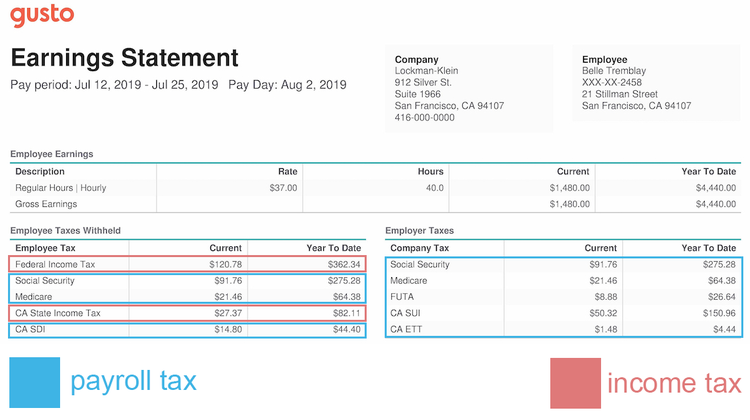

Payroll Tax Vs Income Tax What S The Difference

The Salary Calculator Hourly Wage Tax Calculator Salary Calculator Weekly Pay Loans For Poor Credit